Aadhaar Enabled Payment System: Revolutionizing Banking

In recent years, several solutions have come up in the digital payment ecosystem of India, out of which one prominent solution has been the Aadhaar Enabled Payment System (AEPS). AEPS presents a very secure and efficient payment mechanism that allows any individual to access their bank and financial services through an Aadhaar-based biometric authentication process. This is revolutionizing the way people operate their bank accounts so that transactions can be done even without having physical cards or even PINs. It is most significant in rural areas, where the infrastructure of traditional banking is either scarce or nonexistent.

With the use of AEPS, one can carry out vast banking operations such as withdrawal and deposit, balance inquiry, and fund transfer using only an Aadhaar number and biometric features like fingerprints. This, therefore, has enabled bank access to millions of citizens who earlier had limited access or no access to these services.

We are now going to discuss in detail the prominent features and advantages of AEPS, besides the importance of biometric micro-ATMs. Micro-ATM devices can be highly important for achieving security, ease, and wide acceptability of transactions under the banner of AEPS in deprived regions as well.

What is AePS?

It is the latest innovative solution product of the National Payments Corporation of India, launched under the Aadhaar Enabled Payment System. This offers safe, secure, and seamless banking transactions through means of Aadhaar authentication. The prime intention of the AePS launch is to introduce a cashless and paperless banking environment that ensures that the whole of the country becomes accessible, whether it be remote or underserved areas, to perform financial transactions. It makes use of a unique 12-digit Aadhaar number issued to each citizen of India with the added use of biometric identifiers such as fingerprints or iris scans to authenticate and verify the identity of the user before processing any transaction.

With the implementation of AePS, there is no direct access to wide-ranging banking services through Aadhaar-linked accounts of users, which include withdrawing cash, inquiring about balances, retrieving mini-statements, using cash credit, and even transferring funds to and from any other Aadhaar-linked account, regardless of the bank or financial institution involved. It, therefore is a very versatile solution, not being bound to a specific bank but across multiple financial networks, thus a perfect fit for financial inclusion.

AePS has proved particularly critical for unbanked populations, especially those living in rural and remote districts where the access to traditional infrastructures like bank branches and ATMs is often too meager. Using just an Aadhaar number coupled with biometric data, AePS bypasses the regular use of banking tools of the traditional kind, for instance, cards, PINs, or passwords, and the facility it offers is user-friendly and accessible. This system has put power in the hands of millions of citizens who were previously excluded from using formal banking services, as it brings them into mainstream financial systems and allows them to perform their essential financial activity with ease and security.

Role of Biometric Devices in AePS Transactions

The core of the Aadhaar Enabled Payment System (AePS) is biometric authentication because it is the primary factor that ensures both the security and user-friendliness of the system. This is what makes AePS a revolutionary solution for Indian banking, especially in the most remote and underserved areas. At the heart of this transaction, the customer would provide a biometric scan either fingerprint or iris along with the Aadhaar number of the customer. This will also ensure that the correct owner is operating the account and it will avoid frauds as well as identity thefts.

Biometric micro-ATMs are used to enable these secure transactions. These are portable, mobile terminals that come equipped with either a fingerprint scanner or an iris scanner, which plays a very important role in executing the authentication process. These devices are designed and certified by both the Unique Identification Authority of India (UIDAI) and the Standardization Testing and Quality Certification (STQC) agency for accuracy and reliability in identity verification. The above authoritative bodies ensure that biometric data is captured and processed at the highest levels of security because of the certification they carry.

With high-tech biometric sensors fitted to micro-ATMs, a consumer can make an elaborate set of banking transactions right from the consumer's Aadhaar-linked accounts. In addition, Micro-ATM devices let the consumer withdraw cash safely; besides checking balances and funds transfers, a lot of anything is accessible, actually using just their UID number and biometric details. This helps the system avoid traditional banking tools like debit cards or PINs, thus allowing it to be easily accessed and utilized by users with limited literacy or information and communication technology skills.

Coupled with biometric authentication and portability and flexibility features of the micro-ATM, AePS makes it a relevant and adequate response for this segment of unbanked and underbanked populations in India, who are mostly based in rural areas.

Biometric Devices Used in AePS Transactions

Buy devices at the best price and free installation, easily setup to give AePS services to your customers.

Precision Biometric PB1000: The Precision Biometric PB1000 is an Aadhaar-certified fingerprint scanner with a focus on authenticating biometric data; thus, it is the most significant gadget to securely identify biometrics. All processing of the biometric data in enterprise applications is achieved by this gadget in a very secure way. It is versatile in the fact that it can work with most operating systems that exist, including Android, Windows, and Linux, to provide reliable and efficient biometric identification across a range of environments. The PB1000 is commonly utilized in various sectors to enable secure identity verification and access control. It delivers an efficient experience for applications, such as government and business, that require high-security levels.

Morpho MSO 1300E3: This morpho MSO 1300E3 is considered among the safest and most reliable fingerprint readers in the marketplace. The product has been successful in delivering fingerprint identification quickly and accurately while highly secured. The applications go on to suit it as a device well suited to the process of eKYC as well as other forms of digital identity management.Morpho MSO 1300E3 equipment is certified by STQC and the Federal Bureau of Investigation, thus meeting the highest security standards for applications in biometrics. The operating systems supported are Windows 10+ and Android 7+, thus a lot of devices and operating systems in the public as well as private sectors are taken care of. Its reliability as well as performance position the device ideally in applications whose focus is on security, for example, financial services and governmental programs as well as border controls.

Mantra MFS 100/110 L1: Mantra MFS 100/110 L1 The other high-end biometric device is the Mantra MFS 100/110 L1, which offers the ability to perform high-level fingerprint matching for safe and accurate identification. It possesses high-level FBI certification as well as IP54 protection that makes the device tougher for harsh environments, therefore safeguarding the device against dust and water. This biometric device has advanced cryptography, offering robust protection of sensitive biometric data at authentication. This versatility is established by the fact that this device runs smoothly on two platforms; Windows and Android, allowing it to be hugely used in different applications meant for governmental and business-related use such as public welfare programs, financial services, and identity verification systems. It also provides great options for establishing secure, scalable, efficient biometric authentication processes.

Access FM220U L1: The Access FM220U L1 is a fingerprint reader that offers highly secure encryption and biometric data signing, in compliance with the UIDAI (Unique Identification Authority of India) guidelines for Modular Open Source Identity Platform. This suits government ecosystem applications that are quite secure in requiring authentication processes like DSC or SIM card activation. This FM220U L1 will capture the biometric but further encrypt for secrecy and integrity in case of communication. The product is therefore compliant with specifications that are held by UIDAI and MOSIP, thereby making this product credit-worthy and also reliable for the Aadhaar-based application to access services that might be secure for different types of sectors including telecommunications banking, and even e-governance.

Key Services Offered by AePS

AePS accesses a wide range of banking services through biometric authentication, thereby making it simple and safe. The main services that a customer can access on the AePS platform include:

- Cash Withdrawal: Biometric-enabled micro-ATMs allow customer to withdraw cash from their Aadhaar-linked accounts, mostly in rural areas where such traditional ATMs are not reachable.

- Balance Inquiry: AePS facilitates users to check the balance of their accounts in real-time with the help of biometric authentication.

- Cash Deposit: Customers can deposit cash into their accounts using a biometric scanner, thereby ensuring safe and accurate transactions.

- Mini Statement: AePS gives a mini statement of the latest transactions and account activities.

- Biometric eKYC: Customers may update their KYC details or authenticate for new services through a fingerprint or iris scan.

- Fund Transfer: AePS makes fund transfers between Aadhaar-linked bank accounts so easy that customers need not physically go to the bank to send money to family, friends, or vendors.

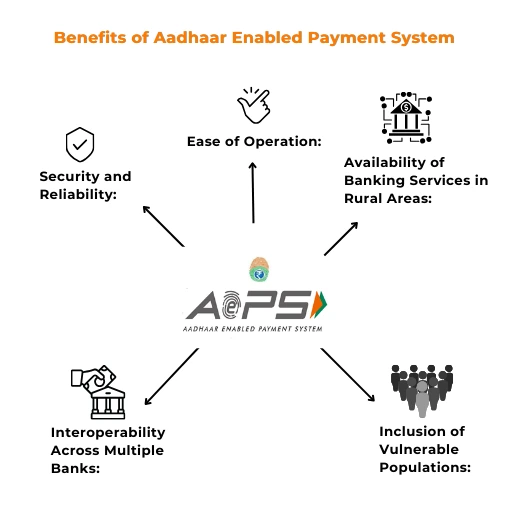

Benefits of Aadhaar Enabled Payment System

AePS provides immense advantages to consumers and banks; therefore, it is the safest and most widely accepted payment system in India as follows:

- Security and Reliability: Biometric authentication is ensured to be risk-free and free from fraud and identity theft. Since everyone's biometric data is unique, it provides maximum security.

- Ease of Operation: Designed to be user-friendly, AePS is accessible to even those with little or no knowledge of banking. All one needs to do is just provide the Aadhaar number while authenticating through a fingerprint scan or iris scan.

- Availability of Banking Services in the Rural Areas: AePS, especially has benefited the rural economy where traditional banking infrastructure and access is limited. By biometric micro-ATMs basic banking services are accessible while saving a visit to bank.

- Interoperability to Access Any Bank: Its interoperability feature makes the system work on all the Aadhaar-linked bank accounts and easy to use the service offered by any number of banks and financial Institutions.

- The inclusion of vulnerable populations: occurs as AePS allows elderly citizens, differently-abled individuals, and those who have difficulty recalling their traditional banking credentials-like account numbers benefit financially.

AePS Transaction Failures: Common Issues and Solutions

Even though AePS is secure and efficient, at times problems arise concerning transactions. Some reasons for failures of transactions include;

- Biometric Authentication Failure: is another common cause for the error of transactions: Scans of poor fingerprints, or damaged iris scans lead to authentication failures. Poor quality in fingerprint scanners or dirty scanning tools may result in errors. Maintaining biometric equipment and ensuring clean fingers and eyes during scanning might solve this problem.

- Network Connectivity Problems: Since AePS requires internet connectivity for transactions, a slow or poor network may cause a delay in transactions or failure of transactions. Banking Correspondents and Customer Service Point operators should ensure that they operate in an area where there is a stable internet connection to avoid such occurrences.

- Wrong information in Aadhaar: In case the Aadhaar number entered is wrong or not linked to the bank account, the transaction will be rejected. So, before proceeding with any transaction, the UID number must be verified and ensured to be correctly linked to the concerned bank account.

- Problems of Bank Server Sometimes: it may also happen that a problem exists on the bank's server downtime or technical problems. In that situation, a user might need to call customer care or wait until the problem gets resolved from the bank's side.

Infrastructure Required for AePS

A banking correspondent or any such financial institution would require hardware and software infrastructure to supply AePS services. One of the primary requirements is as follows:

- Micro-ATM Devices-Biometric: These are the machines that actually perform biometric authentication through certified fingerprint or iris scanners, which read and verify the biometric information of the customer.

- Aadhaar Number: The Aadhaar number of the customer is an important number for every transaction and becomes a unique identifier associated with his bank account.

- Internet Connectivity: It needs a stable internet connectivity to process the transactions properly and efficiently. The banking correspondents and the customer service operators must ensure to maintain a stable network for the transactions to be delivered properly and not delayed.

- Backend Software: The backend software interfaces biometric authentication with the bank's database, so that the Aadhaar number as well as biometric data is validated real-time during the transaction.

Conclusion

Enabled with the Payment System, the change is a game changer in the Indian banking industry. It allows customers to bank seamlessly, securely, and efficiently. With fingerprint biometric authentication or iris, it provides convenient access to core banking services such as cash withdrawals, deposits, balance inquiry, and fund transfer-the things that are quite helpful for rural and remote persons lacking proper banking infrastructure.

AePS is significantly contributing to financial inclusion, ensuring that even the people in the underserved regions can easily access their bank accounts without the need for a physical branch. The biometric Micro-ATMs used for AePS transactions make banking more accessible and secure for everyone, including people with limited literacy or technology access. This system bridges the gap for those who have faced difficulties with traditional banking systems.

The role of CSP operators is very important in ensuring smooth operations since they help customers carry out transactions and troubleshoot any issues. Their support plays a vital role in ensuring customer satisfaction and the efficiency of the system.

With continued investments into biometric technology and its improvement, infrastructure availability as well as adoption would catapult AePS to a center stage for digital banking as a means of facilitating provision of financial services by access to all citizens despite socio-economic background or location.

With continued investments into biometric technology and its improvement, infrastructure availability as well as adoption would catapult AePS to a center stage for digital banking as a means of facilitating provision of financial services by access to all citizens despite socio-economic background or location.

Frequently Asked Questions

How secure is the Aadhaar Enabled Payment System?

Just like that, if you know your ATM card number nobody can withdraw money from the ATM machine; similarly knowing just your Aadhaar number alone nobody can hack into your bank account and withdraw money. Provided you don't part with your PIN/OTP given by banks; your bank account would be safer.

Can I use AePS for transactions across all banks?

Yes, you can avail of AePS services for all transactions across other banks that are linked with your Aadhaar. It offers cash withdrawals, deposits, transfers, balance inquiries, and mini statements at Micro ATMs or kiosks or from a mobile phone. For AePS, you need to link Aadhaar with your bank account and activate this service. The limit for daily transactions through AePS normally ranges from Rs 10,000 to Rs 50,000 and uses biometric security. Sometimes, banks may freeze AePS to ensure security.

What is the role of Biometric Micro-ATM in AePS?

A Biometric Micro-ATM at an AePS allows the outlet to leverage Aadhaar-based biometric authentication involving finger print or iris scan to approve the transaction. After approval, the consumers can continue the deposit, withdrawal, balance enquiry, and transfer for the fund. In fact, it is an ATM on a mobile platform that brings bank services right to the customer's door.

How do I perform a cash withdrawal using AePS?

To access cash through AePS, locate any banking agent or micro-ATM which supports AePS. Enter your 12-digit Aadhaar number on the machine, select "Cash Withdrawal", and enter the amount to be withdrawn. Validate it by biometric. After the successful completion of the transaction, you will receive your cash, a receipt, and an SMS confirmation on your registered mobile number. Unlike such transactions with a regular bank or ATM, AePS will provide the facility of cash withdrawal.